Grow Up

The Lund Loop - Your weekly update on markets, trading, and life.

——————————

MARKET REVIEW

——————————

*Click any chart to enlarge. Please read disclosures at the bottom of this page.

The first half of the year is in the books and it was solid.

The S&P 500 finished the first six months of the year up 17%, the best performance since 1997 - a year in which the market ended up over 31%.

So let’s overthink this for a moment.

The S&P 500 is already way past its average annual return of 9.8% over the last 90 years.

What’s more likely to happen in the next six months; that we continue moving higher, or turn back lower?

Fortunately, we don’t have to make that call, nor do we have to care.

As active traders and investors, we’ll go where the market and the technicals take us and make the best of whatever is thrown at us.

That’s a pretty good feeling, right?

Having said that, check this out…

I really like this tweet and the sentiment behind it for a couple of reasons;

When everybody is on one side of a trade (or bias), the market usually goes the other way.

It’s cliche’ but the market likes to climb a wall of worry. And there’s a lot of worry out there.

In addition, a lot of my beat up long-term positions - yes, I’m an investor as well as a trader - started moving this week.

Combine these anecdotal points with the improving market technicals, and the stage is being set for a strong move higher.

But as we’ve seen before, that can all change in a moment - or a tweet - so we’ll try stay as unbiased and unopinionated as possible going forward.

Now, on to the charts….

S&P 500 Index (SPX)

NASDAQ-100 Index (NDX)

Dow Jones Industrial Average (DJIA)

From last week’s Lund Loop;

As always, a base for a week or two here would be best before heading into new highs.

This week the three major averages did exactly what we wanted them to do - nothing.

The longer we base here near all-time highs, the better chance that a break above them holds.

Russell 2000 ETF (IWM)

After being the laggard for the last few months, we finally saw some good action in the IWM relative to the other indexes, which is important because this is the broadest one of them all.

In a week when SPX, NDX, and DJIA were all down, the Russell 2000 was up 1.09% and closed above all four major moving averages (21, 50, 100, and 200).

This is good news.

S&P 500 Volatility Index (VIX)

After trying to rally early in the week, the VIX turned lower on Friday, closing down for the week. This is good.

Die, VIX, die.

iShares MSCI Emerging Markets ETF (EEM)

After last week’s breakout, the EEM pulled back to the trendline, kissed it, and moved higher, giving us more evidence that a trend change is in process.

iShares Trust China Large-Cap ETF (FXI)

The FXI closed the week basically unchanged and won’t likely go anywhere until we get more clarity on the China-US tariff negotiations.

iShares MSC Switzerland ETF (EWL)

Just an interesting aside.

I wrote this on May 25th, when it looked like the SPX was rolling over';

Meanwhile, EWL hits fresh 52-week highs. Go Switzerland!

Since then it’s hit a few more. File under: The trend is your friend.

Financial Sector SPDR (XLF)

The XLF made a clean break above a minor trendline, indicating that the intermediate-term trend is still up. This is good news as the financials traditionally lead the markets higher.

SPDR S&P Homebuilders ETF (XHB)

We’ve talked before about the many minor resistance levels XHB still has above it, but you can only take them on one at a time. And this week we closed above another one.

VanEck Vectors Semiconductor ETF (SMH)

Similar to the EEM chart, SMH broke, kissed, then bounced from the shortish-term trendline. This is good for the market and tech in general.

US Dollar Currency Index (DXY)

CBOE Interest Rate 10-Year T-Note (TNX)

As always, I’ll let those smarter than I interpret the macro significance of these two charts, but from a technical standpoint, DXY finally broke below a long-term trendline while TNX broke down close to 3-year lows.

SPDR Gold Trust (GLD)

iShares Silver Trust (SLV)

GLD rested as it should after its recent rocket ride. But what’s interesting this week is SLV.

Silver traditionally follows gold at some point - and none other than Paul Tudor Jones thinks that may be the case here soon.

Technically, silver hasn’t been able to get above that long, long-term down trendline, but it’s basing close to it. A break above might mean the PTJ knows what he’s talking about 😄

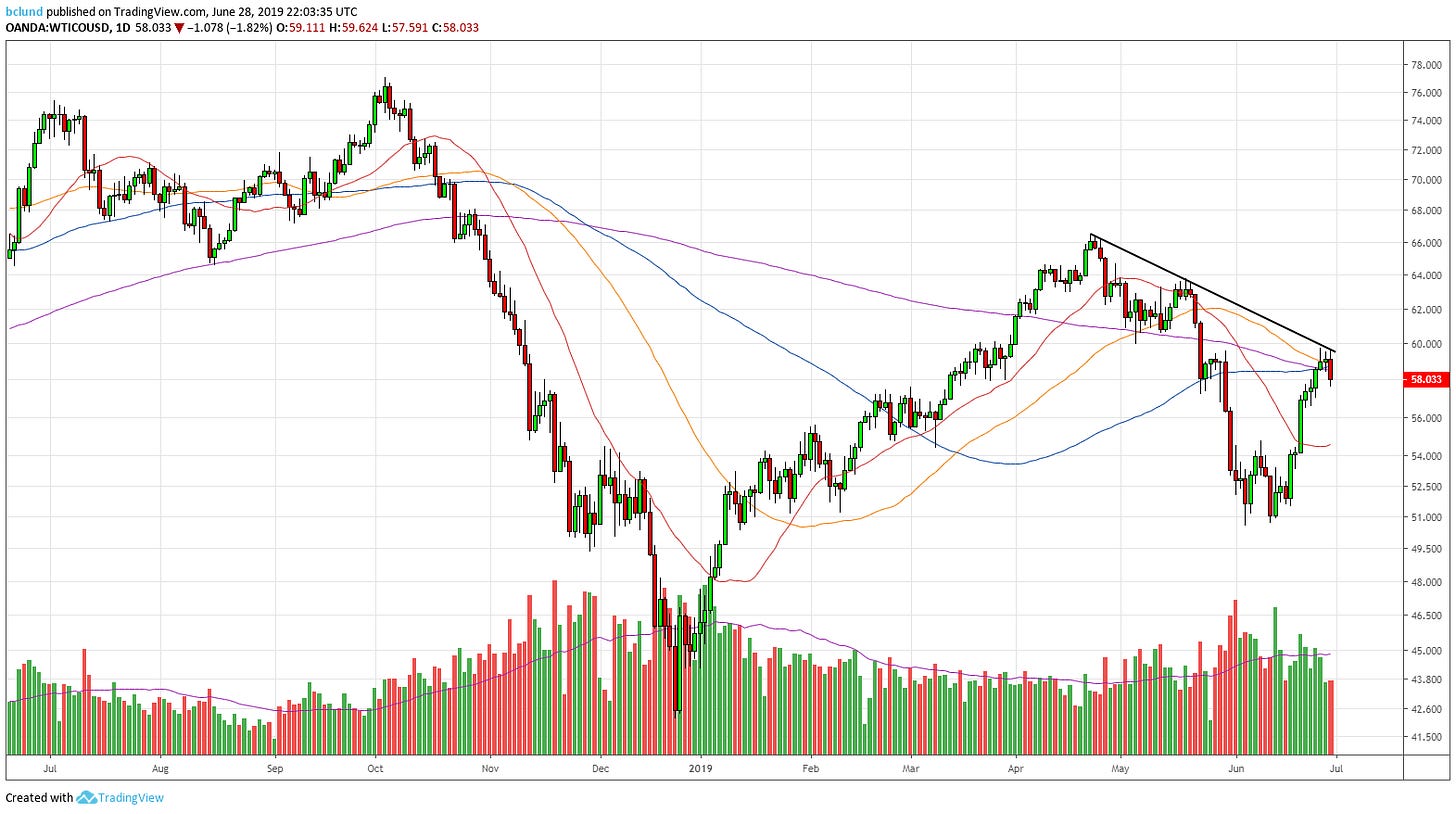

West Texas Oil (WTIC)

VanEck Vectors ETF Trust Oil Services (OIH)

From last week;

Oil got a nice pop this week on new tensions with Iran. Still, until that down trendline is broken, the trend is down.

This week, oil touched the bottom of that trendline before retreating and OIH made a nice move as well. We’ll be keeping a close eye on the price action around that trendline going forward.

ETFMG Alternative Harvest ETF (MJ)

From last week;

There was some interesting action in cannabis stocks on Friday. Canopy Growth (CGC) announced large losses and the whole sector tanked at the open. But by the close, a lot of individual stocks had reversed and put in hammers, not unlike the one here in MJ.

It did feel like some capitulation selling was going on, but until this downtrend channel is broken, well, you know the drill….

This week there was a TON of pro-cannabis legislation either passed or introduced in both state and federal legislatures - yet this index didn’t really react.

So until we break out of this down channel - one way or the other - there’s not much to see here.

Bitcoin (BTC)

It was a week in which we were reminded how volatile the crypto space can get as BTC dropped $3500 in about a day. It’s made a good chunk of that drop back, but it could still use some consolidation before it attempts to move higher.

Fundamental Facts:

S&P 500 -0.29%, Dow -0.45%, Nasdaq -0.32% and Russell 2000 +1.09%

The best asset class returns this week were Small Value Stocks (+2.25% ) and the worst were Large Growth (-0.89%).

Potential market-moving data next week: International Trade numbers (Wed), Jobless Claims (Thur), and Employment Situation (Fri).

——————————

TRADING

——————————

*Click any chart to enlarge. Please read disclosures at the bottom of this page.

The last couple of weeks have been light in terms of good setups. This happens from time to time and we just have to be patient.

Having said that, we only had two triggers from last week.

ALLY Financial (ALLY)

ALLY had a nice clean breakout, ending the week up 3.65%

McDonald’s (MCD)

MCD, or MehDonald’s, broke out of a minor flagged an tacked on 1.66% for the week.

Intuit (INTU)

INTU didn’t trigger, and it’s not quite ready yet, but if the market as a whole moves higher, my gut tells me this one does too.

Northrop Grumman (NOC)

Back in the April 20th Lund Loop I wrote this;

What we’re seeing here in NOC is the possibility of a trend change.

The top chart shows us resistance in the form of a long-term downward sloping trendline.

The bottom chart shows price compressed between the intermediate-term (50-day) and long-term (200-day) moving average. Watch for a break above this consolidation area.

NOC is up 14.8% since then and the trend change is definitely confirmed.

Okay, on to this week’s setups….but first….

So I don’t have to bore you with repeating it on every chart where we are looking at setups, the most important thing we want to see when they trigger is an expansion of volume - the more the better.

Simply put, a breakout with increased volume has a better chance of succeeding, and one without an uptick in volume is more likely to fail.

For illustration, let’s look at NTVA, a stock we’ve highlighted a few times in the past.

Invitae Corp (NVTA)

In mid-May, NVTA gapped down big, on massive volume. That volume was a clue that the stock was not likely to rebound quickly.

It then spent 7-weeks doing some solid sideways work, until Friday when it filled the gap, moving up 9% - and on 5x its average daily volume.

Friday’s volume spike gives us more confidence that this gap fill will hold, just like it should give you more confidence on a breakout (or break down).

As always, price is the final arbiter no matter what volume does, but it’s a key metric to watch to help keep the odds in your favor.

Apple (AAPL)

AAPL is building a base upon base here, which is good as all consolidation is. Buy point is a break above the top rectangle on increased volume (<—last time I say this, I promise).

Amazon (AMZN)

AMZN setting up nice here. A break above the trendline is your super go signal.

Facebook (FB)

Similar pattern here in FB, with a break above the down trendline….blah, blah, blah.

Netflix (NFLX)

NFLX is not ready yet, but keep an eye on that overhead level as we’re going to be looking for a setup right below it.

Applied Materials (AMAT)

You can use Friday’s red candle as a good risk/reward range on a breakout above this minor resistance level.

Broadridge Financial (BR)

BR is consolidating in a tight range, above all four MAs, and in a cuppy handley kind of pattern. Watch for a breakout on increased volume (<—I lied).

CF Industries (CF)

I like this one, though if it goes it will likely be a slow mover.

CF has put in some good bottoming work, basing sideway for almost 7-months before breaking above a decent resistance level. Since then it has consolidated in a tight range. A break of the top of that range would be your buy point.

Capital One Financial (COF)

If the financials get moving - as we are starting to see in XLF - we’ll want to keep an eye on its component stocks.

COF looks like it’s about to complete a major trend change as it is squeezed between the MAs and this down trendline.

MGM Resorts (MGM)

I wrote this about MGM last week;

We’ve talked a lot about two important trading concepts in past;

Keeping your eye on a trade.

False breakouts.

This MGM chart embodies both of those topics.

We had this stock as a potential short a couple weeks back, and although it initially went in our direction, it quickly reversed. And if you took it off your watchlist, that would have been a mistake because the false breakout - as often happens - led to a nice 11% move in the opposite direction.

That move may just be the beginning. MGM is consolidating nicely just below a resistance level. A break above that rectangle would be a buy point.

Target Corp (TGT)

Retail is dead. No, it’s not. Yes, it is.

Who gives a fuck?

What we care about are the technicals and TGT has pulled back to the 21-day MA, forming a nice tight down channel in the process. A break out from that channel is a buy point.

Village Farms International (VFF)

VFF is a cannabis adjacent stock. They provide greenhouses, greenhouse supplies, and all sorts of other equipment to help you increase your yield of tomatoes, lettuce, basil, and the icky sticky.

We don’t really care about the story, but sometimes it’s fun to talk about.

What’s more important is the descending triangle that’s being formed during a pause in an uptrend. A break out from that triangle may signal the next phase of that uptrend is beginning.

VMware (VMW)

We don’t get emotional about stocks, but I hate this stock, which is why I’m glad it’s setting up short.

After a big gap down in late May, VMW has moved sideways, bouncing off a support level three times. That level now corresponds with the 200-day moving average.

A break below that level would be a good shorting opportunity.

Market & Trading Links:

The market is at all-time highs so of course there’s a billion-dollar sneaker exchange. (New York Times)

Every few months I make this stupid reference on Twitter, which I’ve pretty much beat into the ground.

But here’s what’s crazy. If you still have Lehman stock, it’s worth something. (Bull Market Gifts)

Asia rising. (Fat Tailed and Happy)

Are you really doing anything different than other traders? (TraderFeed)

Activist investors are (finally) learning how to work with Wall Street. Democratic candidates take note. (Axios)

News Flash: Companies that disclose SEC investigations don’t do so well afterward. (Institutional Investor)

Unlimited upside is what everybody wants. You can get it. But it comes with a price. (The Irrelevant Investor)

More on Comrade Bernie’s bid to crush the stock market. (The Compound via YouTube)

I’m devoid of the sports fan gene, thus, I have no idea who Luol Deng is. But apparently, he’s amassed a real estate empire while playing professional ball-goes-in-round-thing. (Forbes)

Does the investment industry care if you make money? Or are they just trying to make you feel good? (Behavioral Investment)

There aren’t enough LOL’s in the world for this. (Click the tweet, trust me)

This hasn’t happened to bonds in three years. OMG!!! [I think]. (Sentiment Trader)

I get 20% of your winnings - how to win any bar bet about the stock market. (A Wealth of Common Sense)

VCs and private equity have sucked all the value out of a company by the time it goes public. But what can you do? (Points and Figures)

In light of Brexit, London is desperately trying to maintain it’s hold as one of the world’s major financial centers. (The Economist)

Small costs matter. No, they really do. (Fat Tailed and Happy)

ETFs are awesome. But they’ve been done before. About 200 years ago. (Investor Amnesia)

“Profits on the exchange are the treasures of goblins. At one time they may be carbuncle stones, then coals, then diamonds, then flint stones, then morning dew, then tears.” (Lapham’s Quarterly)

——————————

LIFE

——————————

Scott was an annoying kid. And weird, in a time when that trait wasn’t well tolerated.

I saw a lot of him in the mid-80s because we attended the same high school and he lived directly across the street from my best friend.

But he was a lower classman, so I barely acknowledged him, even when our parents carpooled to Friday night football games and I had to sit next to him.

Scott didn’t play sports, didn’t surf, wasn’t involved in student government or school clubs, in fact, he didn’t do much of anything until his junior year, when out of nowhere, he formed a band with some classmates called Soi Dissant.

An odd subset of England’s new wave scene, New Romantic music had died five years previous, without ever creating much of an impact in the US – making it the obvious choice for a strange kid like Scott and his band to play.

Their first gig was during lunchtime in the quad, and it was terrible. They were bad. Really bad.

His bandmate’s musical skills were rudimentary, and Scott, never having sung before, was just plain awful as lead singer.

Over the next few years, his band played the odd backyard party or beach bash, but other than that, I didn’t see much of Scott after graduation.

The last time we spoke was in 1987.

It was a Saturday night, and I was working a two-to-ten shift as a bellman at a the Sheraton Newport, hoping to duck out early and meet my friends at our favorite watering hole, Hogue Barmichaels.

But my shift ran late, and by the time I got to the bar, there was an hourlong wait. It was a time before cell phones, so I went up to the front entrance hoping to spy a friend inside and let them know I was going somewhere else.

When I got to the door, I saw Scott, inside, casually chatting with a bouncer.

“Brian?” he yelled, coming out to greet me.

“Hey man, are you coming in?” he asked.

Scott was annoying, but Scott already inside a bar I was waiting to get into was irritating.

“No, I’m leaving. The line’s too long,” I said.

“Don’t worry about the line, come on,” he said, grabbing me by the arm and leading me towards the entrance.

What the hell is this kid doing? I thought. He’s gonna get us both thrown out.

As we got to the doorman, whom I was sure was going to kick my ass, Scott said, “Jake, this is my friend Brian. He’s with me.”

And just like that, we were in.

Being the dick that I was back then, I don’t think I even thanked him before peeling off into the crowd to search for my pals.

Not long after, Scott moved to San Diego with his band, having changed their name to Mighty Joe Young.

When they hit it big in 1992, partly from a desire to atone for being such a jerk, and partly from a desire to star fuck, I wrote Scott a letter.

I’m sure I congratulated him on his success, but I’ve forgotten the rest, save for one part, which I remember vividly for its sheer awkwardness in an already awkward letter.

“Stay true to yourself, keep away from the drugs, and you’ll do great.”

I first met Maurice in 2nd grade, and I can’t remember a time afterward when he didn’t have an instrument or book of sheet music in his hands.

Both of his parents were classically trained musicians who wanted nothing more than for their son to follow in their footsteps.

Each day he was expected to spend at least four hours on his music lessons, and every week he seemed to be in a recital.

Also, he was only allowed to play or listen to classical music. It was the only type of music allowed in his house, a rule, which at first, I was unaware of, and later, ran afoul of when we were in high school.

“Are you coming over after class?” Maurice asked.

“Yeah,” I replied. “And I’m going to bring my new record.”

When I got to his house, his father answered the door.

“Hello Brian,” he said. “Are you here to see Maurice?”

“Yes, I am, Mr. Hutter,” I said. “We’re going to listen to my new record,” which I was holding under my arm in a purposely evasive way.

“Oh, that’s fine. Whom do you have today?” he said, gesturing towards the album.

“Ted Nugent,” I said.

“Ah, Ted Music,” he replied. “That sounds great. Come on in, Maurice is in his room.”

To my knowledge, alongside the names of the great classical composers like Beethoven, Mozart, and Bach, there is no Theodore Music, and I’ve often wondered what type of music Mr. Hutter thought I was bringing over that day.

Ted Music? Hmm, it’s probably show tunes. I guess I can make an exception. Young kids love show tunes.

In any case, it must have been quite a shock to Mr. Hutter when the opening cords of “Wang Dang Sweet Poontang” came blasting out of Maurice’s room.

The Nudge was a gateway drug for Maurice, and I was his enthusiastic pusher, getting him hooked on all types of bands, from hard rock to punk rock – and everything in between.

Eventually, he just gave me money to buy him these illicit records, which he’d hide in classical albums sleeves, so his parents didn’t find out.

After high school, Maurice left for the Berklee College of Music in Boston. A few years later, I saw him one last time, when he came to town for a visit, before heading off to New York City to fulfill his destiny of becoming a concert violinist.

Craig ate my lunch all through grade school. He didn’t just take it, he asked. Politely.

And he didn’t want the good stuff like tacos, Sloppy Joe’s, and Salisbury steak. He wanted the stuff I left behind. The refuse. The vegetables.

Craig was unusually big for his age – any age for that matter – and it served him well in his sport of choice, football.

He had been playing since he was old enough to suit up, and his dad – who was rumored to be a member of the Lombardi era Packers – was 100% focused on getting his son to the pros.

Craig and I continued our shark/remora type relationship until 6th grade when we attended different middle schools.

By the time we were reacquainted on our high school football team, he was a 6’4” 275lb giant - and didn’t remember me.

In his senior year, a group of sportswriters named him a nationwide First-Team All-American, and he didn’t disappoint, dominating any and all opponents he faced that season.

My lasting memory of Craig is one of watching him knock down three defensive linemen at once, and in the process, creating a hole at the line of scrimmage you could drive a bus through.

Glenn was in the same graduating class as Craig, but he was an enigma.

In the three years I spent with him in high school, I only saw him a handful of times. And he wasn’t easy to miss.

Glenn was 6’5” and fat. Real fat. The doughy type of fat. And his body was kind of pear-shaped. In addition, his hair was super frizzy, and he wore odd clothes – even for the 80s.

But he was quiet. Super quiet. The meek type of quiet that made you think that if the smallest kid in class went up to him in the hall and punched him in the stomach, he would have winced, then turned and walked away.

One rumor had him hanging out in smoker’s field all day. Another said that he cut class to go to the beach. Yet another claimed he’d already graduated a few years previous but came back from time to time because he had no friends.

But whatever the truth, he made little if any impact at Edison High, playing no sports, taking part in no school activities, and moving like an apparition – albeit a fat one - through the school corridors.

Greg was my next-door neighbor for as long as I could remember. He liked guns. And tanks. And anything to do with the military. Particularly airplanes.

He plastered his bedroom walls with posters of jet airplanes the way most teenage boys in the 80s plastered their bedroom walls with posters of rock bands and swimsuit models.

His goal was to become a fighter pilot, and there were no two ways about it.

As his father was an astrophysicist at Northrup-Grumman, Greg got to visit the plant regularly, and when he did, he’d immerse himself into every aspect of the jets he watched being built.

He could tell you all about them, from their thrust capacity to the guidance systems - even the armament packages they carried – Greg knew each model backward and forwards.

Which is why it was no surprise that he joined the Air Force Junior ROTC his freshmen year in high school, eventually rising to the rank of Cadet Colonel by graduation.

Ty was my smartest friend by far. He was also the most focused. When he put his mind to something, no matter what it was, he always excelled.

And though he was my friend, this combination of traits was irritating.

Because it enabled him to hang out and party all night long, then show up to school first thing in the morning, and ace every test – while the rest of us failed miserably.

It also allowed him to practically will himself into the starting line-up of our football team.

Weighing 185lbs soaking wet and holding a brick, he somehow managed, as a sophomore, to take the center position – on a team whose average lineman weighed 230+ pounds – away from a senior.

It was this type of drive that made him successful at everything he was interested in, be it school, sports, or just life in general.

One thing I never heard him express any interest in was the military. I don’t think he ever mentioned it once in all the time I knew him. So while guys like Greg – and other friends of ours – dove headfirst into ROTC, Ty never even gave it a thought.

Which is why I thought it supremely odd that when it came time to choose a college, he chose the US Air Force Academy.

Last week I was in a bedroom at my house, disassembling a massive three-piece IKEA wardrobe.

When I bought it ten years ago, it was so big, that I had to build it in the room.

Even though I knew logically that someday it would have to be moved, it seemed like that day would never come.

But we’re making changes in the Lund house. Kids are getting bigger. They’re growing up. And that means moving things, and rearranging things so that everybody can have their own space.

My son came in to watch me take the behemoth apart, and after a while, we got to talking – and the changes taking place prompted him to ask about “growing up.”

I asked him what he wants to be when he grows up, and he thought about it for a few minutes.

“A baker,” he said. “Or a miner. I’m not sure yet.”

My daughter chimed in from the next room.

“I want to be a therapist. I’m good at giving my friends advice on Discord.”

“That’s great,” I said. “Plus, therapists make good money.”

“Oh, I’m going to do it for free,” she replied.

Welp.

Then my son asked, “how do you know what you’re going to be when you grow up?”

“You never really know,” I said. “Sometimes you think you do, but it doesn’t always work that way.”

Greg had a passion for jets, but not a passion for studying, and his low GPA made an appointment to the US Air Force Academy an impossibility.

He never joined the Air Force, and never flew a plane, and now owns a military surplus store in Barstow, California.

John “Ty” Thomas graduated 2nd in his class from the US Air Force Academy, went on to Harvard, then deployment, and has logged over 4000 hours in eleven different aircraft.

In 2018 he was promoted to 3-star Lieutenant General in the US Air Force.

Craig was heavily recruited out of high school, choosing to go to the University of Oregon, where after redshirting as a freshman, he started three years in a row for the Ducks.

He was a late draft choice by the Vikings in 1989, but was cut in training camp. He now sells real estate in Daytona Beach, Florida.

Glen Parker became a starting lineman at Golden West Junior College, then at Arizona State. He was a 3rd round draft pick by the Buffalo Bills in 1990.

During his career, he played all five offensive line positions and appeared in 16 postseason games, including five Super Bowls – starting in three of them.

Maurice tried for years to make a chair with the New York Philharmonic, then the Boston, Chicago, and Cleveland Symphony Orchestras after that.

He eventually developed arthritis in his right hand and put his instrument down for good without ever playing a professional note.

He now lives in Omaha, Nebraska with his wife and writes a blog about organic gardening and the benefits of composting.

Scott Weiland went on to sell over 20 million records as the lead singer of Stone Temple Pilots and Velvet Revolver. He died on December 3rd, 2015 from an accidental drug overdose.

“What did you want to be when you grew up?” my daughter asked.

Over the course of my life, I’ve been many things.

A busboy, a bellman, a businessman, an entrepreneur, semi-retired, a full-time trader, unsemi-retired, financial services executive, unemployed, fintech executive, unemployed, writer, unemployed, and senior content manager.

“I don’t know. I didn’t give it much thought,” I said.

I still don’t.

It’s Good, It’s Good

Wolves. They can change rivers. (YouTube)

Back in the late 80’s I saw my first cell phone. Then it seemed like everybody had one. Space travel is going to be like that very soon. (Daily Beast)

This is the one skill you can master to make sure that you are always in the game. Believe me, I know. It literally changed the trajectory of my life. (Seth’s Blog)

Ramp. Capital. What else do I have to say? (Ramp Capital LLC)

Nature is awesome. Nature is beautiful. Nature is gentle. Except maybe for this mercenary parasite that lives inside the eyes of fish. (New Scientist)

Are you outraged by the fact that your school is named after some racist bastard from America’s Confederate past, but, you’re on a budget? No problem. (The Wall Street Journal)

The best podcasts of 2019 - so far. (AV Club)

They’re building a long-term nuclear waste storage facility in Finland that will outlast the human race. (Pacific Standard)

How Manhattan’s neighborhood’s got their names. (Mental Floss)

I’m a closet astronomer (in my mind). Someday I’m going to make a real effort to look at the night’s sky. Until then, here’s my cheat sheet. (Atlas Obscura)

If you’re lonely, you’re only likely to get lonelier. (The Atlantic)

The next financial crisis in America? Weddings. (Washington Post)

My cousin. Snark runs in the family.

If you’d like to get trade setups every Saturday - as well as everything else The Lund Loop includes - or you just want to support independent content creators like yours truly, become a Lund Loop subscriber by clicking the button below.

Thanks,

-B

———————————

Thanks for reading this week’s edition of The Lund Loop.

I want to hear your opinion on these, or any other topics you see fit to pontificate on.

So drop me a line.

If you arrived here by accident, happenstance, or magic, make sure that you become a paid subscriber to The Lund Loop to have it automatically delivered to your inbox once a week - isn’t technology great?

And if you really like The Lund Loop, why not purchase a subscription for a friend, loved one, or division of co-workers?

Talk to you soon,

-B

P.S. It should go without saying - but I’ll say it anyway - all opinions expressed here in The Lund Loop are my own personally and don’t reflect the views of my employer, any associated entities, or other organizations I’m associated with.

Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.

Hey folks, It’s Brian. I love getting feedback so feel free to comment about anything you read in this week’s Lund Loop.