Having been on both sides of the aisle; the trader side and the brokerage side, I think I have a different perspective on the issue of stop placement than most.

During my time on the brokerage side, I got to see a lot of what goes on in the soft underbelly of the trade execution world, and I also talked to a lot of traders who initiate those executions.

One of the complaints that I often hear from retail traders is, “I can’t believe it, they hit my stop and then ran the stock right back up.”

This is definitely one of the most frustrating things that can happen to a trader, and when I hear it my empathetic response is…

“No duh? Of course, they hit your stop, they knew right where it was.”

But they’re not supposed to be able to see your stops right? And if they can’t see them, then how can they go after them?

More on that in a minute.

First, let me take a moment to clarify who “they” are.

To tell the truth, I don’t know who “they” are, but I watch “their” actions every day.

They could be market makers, specialists, bots, HFT’s, Algo auto-traders, a combination of all of them, or just the spirit of the late Paul Lynde.

It doesn’t really matter what the mechanics are, it’s just the results of those mechanics that matter.

The bottom line is that many entities in the market benefit from volume and they do anything they can to create that volume, like triggering your stops with only a quote instead of an actual trade which I’ve written about in the past.

This type of market action has changed the rules of trading, and let’s face it, the rules of trading have always been pretty dicey to start with.

If you had a 50/50 chance of a certain trading rule holding up in past markets, it’s now more like 25/75.

Of course, I am just pulling those numbers out of my ass, but you get the point; the market has changed, and you have to change the way you trade it, especially when it comes to placing stops.

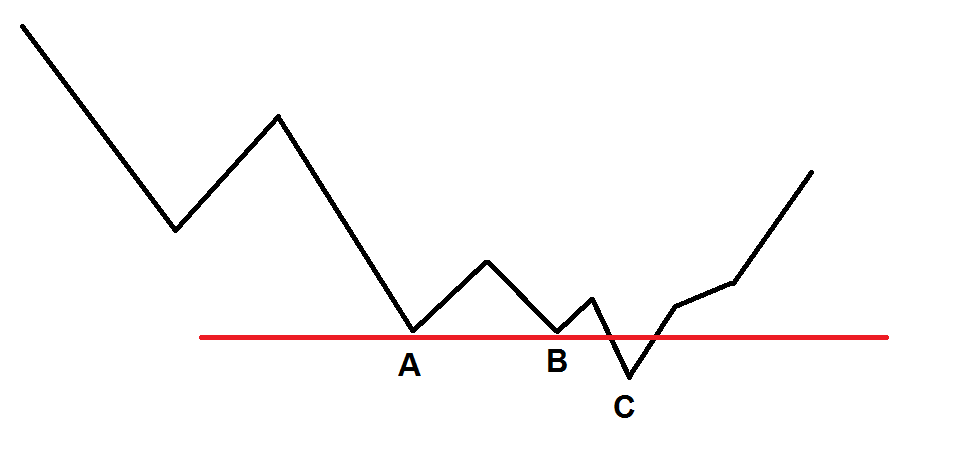

Let’s start with an illustration that I painstakingly created in a very high-end program called Microsoft Paint.

In days of yore, the way this trade would have been played out is that you would have waited until a double bottom was put in at point B, entered on the bounce, and put a stop in below the red line.

If your trade did indeed fail and stop you out, it would normally continue on down to new lows. But that’s not how it works these days.

More often than not, before the trend completely reverses and moves back up, you get one last shiv, as price quickly drops below the double bottom to point C, and then just as quickly reverses back up above the support line and continues to run higher.

This is when I hear the retail traders start to holler about their stops being hit, run, liquidated, or “spanked” depending on what they are into.

So can they actually see your stops and go after them?

No, they can’t, not in the sense you think they can.

In the past, if an individual, trading in size, wanted to try to run the stops, well they didn’t have to be a genius to know where everybody and their brother put theirs.

Just by looking at a chart and understanding human nature, they could figure that out.

Today in the world of robo-trading, “they” know the same thing, it’s just that they are programmed to know instead of having a live human driving the strategy.

So “No!” Mr. and Mrs. retail trader, they are not running your 100, 500, or even 1000 shares of XYZ, they are running the 10’s of thousands of shares of XYZ that they know are sitting just below the double bottom of the day.

And if you are buying a breakout, it’s basically the same concept.

Price runs up, pulls back, bases, and proceeds to break to new highs, but then pulls back to point C and the wehewqlkg etoetdg=reegr.g.gge;wp %$$%()SSQds…….

Sorry, my cortex just snapped from repeating myself for the millionth time. I don’t need to belabor this point, you get what I am talking about here.

So the big question; how can I put in more effective stops?

There are basically three ways to do it, each of which I will make up a random and important sounding name for.

The Johnny Sokko And Giant Robot

This involves adjusting your position size based on a “stop plus” methodology.

Normally, by knowing the spread between your entry and your stop below support, you can divide that into your max $ loss per trade and determine your position size.

But based on the new market dynamics you need to add a “plus” factor to your stop, in essence making your position size smaller while giving you a better chance to avoid getting shaken out on a run of the obvious stop level.

What you use for a plus factor depends on what type of asset class you are trading, the specific traits of the instrument in that class, and the overall market tenor.

A suggestion would be to start experimenting with a fixed percentage of the daily average true range (ATR) and adjust depending on the results you see.

A Rainbow In Curved Air

Here you would actually anticipate the run of the stop area at point C on the above chart and put a limit buy order there.

Basically you are not buying support anymore, you are buying “support minus.” What your minus amount is once again would need to be experimented with, but as a variation, you could break your position into two or three limit buys in a range below support.

The advantage to this method is that if you do get filled below support and price does not rally back over that level, you can be reasonably sure that support has truly failed and price will continue lower, making your stop out a no brainer.

The Larry Tate Experience

The last method is a hybrid of the previous two for those that worry they will miss a move if they try to buy below support.

I mean, what if price never gets to your order and they don’t get filled right?

OH, THE HUMANITY!

So instead, you take a half position on the bounce off of (or past) point B.

If price continues to run so be it, but if it makes a stab past support to point C, you have some dry powder to grab the second half of the position.

This ultimately gives you a better average price, and once again allows you more room for price to run back up before stopping you out, though not as much room as the “Rainbow” method.

Conclusion

It is a common saying that trading is “chess not checkers,” but these days it is more like that 3D chess game that they had on Star Trek, with a helping of Dungeons and Dragons, and some poker thrown in.

You can no longer think in a “logical” way and have to be able to modify the traditional trading rules when it comes to stop placement and trade management.

And even more critical is the ability to think on different levels, many moves ahead, and be willing to evolve your methodology for the ever-changing market.

Want more? Become a paid subscriber to the Lund Loop newsletter and you’ll get;

Market Review Video

Next Week’s Setups

Updated Daily Charts

Discord Access

Curated Market Links

Much more…

Just click the button below and become a subscriber today.

————————

P.S. It should go without saying - but I’ll say it anyway - all opinions expressed in The Lund Loop are my own personal opinions and don’t reflect the views of my employer, any associated entities, or other organizations I’m associated with.

Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.