The Lund Loop Daily Snapshot - 05/02/23

The ‘Daily Snapshot’ is a brief recap of today’s market action.

To get actionable profit opportunities & market analysis sent to your inbox daily, as well as access to our exclusive members-only Discord, become a paid Lund Loop subscriber today.

Chart Spotlight

In yesterday’s ‘Daily Spotlight’ I wrote the following;

Jamie Dimon then soothed the market even more by saying “this part of the crisis is over.”

That may be true, but the current price action in the regional banking ETF KRE tells us that the next part of the crisis may still be ahead.

Today, KRE’s action price told us that “ahead” means today, as it crashed below its recent support levels on worries that more banks may fail.

On another, semi-related topic, that hasn’t gotten as much attention as it should, legendary investor Carl Icahn lost roughly 17% of net worth today when famed short sellers Hindenburg Research issued a negative report on his holding company, Icahn Enterprises, in which 85% of his wealth resides - and tanked the stock 21% on the day.

For more on these stories, as well as a full recap of today’s action, plus my watchlist of stocks that are poised to move, click the button below to become a paid subscriber to the Lund Loop.

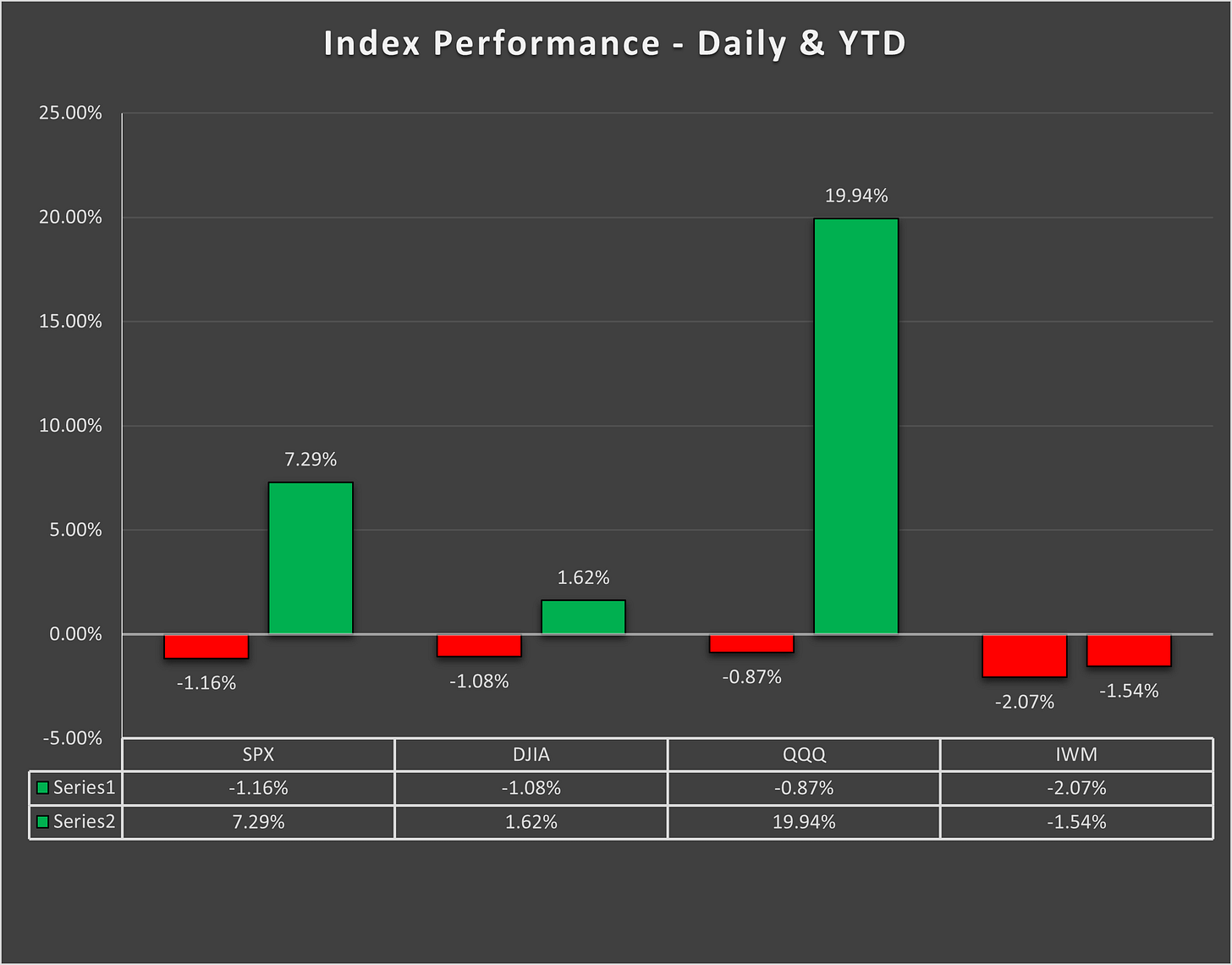

Today’s Market Recap

Sectors: 10 out of 11 sectors were DOWN.

- Winner: Consumer Discretionary +0.16%

- Loser: Energy -4.28%

Charts of interest: SPOT 0.00%↑ LEN 0.00%↑ TOL 0.00%↑ KBH 0.00%↑ MGM 0.00%↑

Note: The cash tags above are a new feature for Substack and the quotes still look a little wonky so refer to the prices in the ‘Daily Update.’

Daily Update Video & Watchlists

To get today’s full ‘Daily Update’ video, as well as access to the watchlists and our exclusive members-only Discord, click the button below to become a paid subscriber.

It should go without saying - but I’ll say it anyway - all opinions expressed in The Lund Loop are my own personal opinions and don’t reflect the views of my employer, any associated entities, or other organizations I’m associated with.

Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.