In yesterday’s ‘Daily Update’ video I talked about how over the past seven trading days the VIX has tried to close above the 26.50 and been rejected every time, indicating that a reversal lower might be in the cards.

Today we got that reversal, which corresponded with the whole market lifting in front of the Fed decisions. And there, of course, is the rub.

Despite the indexes - and many individual charts - looking pretty decent, that could all go out the window depending the market’s reaction to tomorrow’s announcement.

Stay tuned…

For more on this, check out today’s ‘Daily Update’ video below.

The ‘Daily Update’ includes a review of the day’s market action, updated charts, from the Saturday ‘Market Strategy’ video, and setups ready to trigger.

For intraday updates please join the Lund Loop Discord.

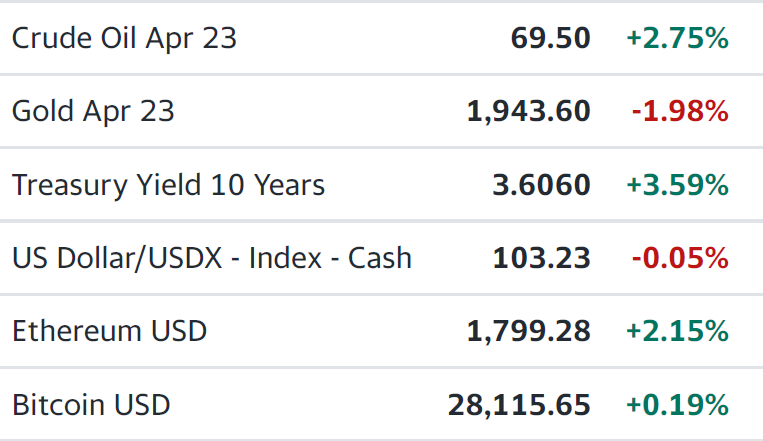

Market Snapshot

Sectors: 8 out of 11 sectors were UP.

- Winner: Energy +3.45%

- Loser: Utilities -2.06%

Daily Update Video & Watchlists

Charts of interest: RBLX 0.00%↑ SPOT 0.00%↑ AMZN 0.00%↑ NVDA 0.00%↑ OKTA 0.00%↑ MSFT 0.00%↑

Note: The cash tags above are a new feature for Substack and the quotes still look a little wonky so refer to the prices in the ‘Daily Update.’

Check out this short video for a full explanation to use the Lund Loop watchlists to identify potential profit opportunities.

Click the links below for the ‘Daily Update’ video and to view the current watchlists & setups.