Bias is our nemesis. Particularly recency bias.

Recency Bias- A cognitive bias that favors recent events over historic ones; a memory bias. Recency bias gives "greater importance to the most recent event", such as the final lawyer's closing argument a jury hears before being dismissed to deliberate.

For the past few months we’ve seen potential follow-through days start strong, only to end the day lower. And that’s what it looked like was going to happen today.

Then, much to my surprise, halfway through the session we found support right above yesterday’s high and steadily grinded higher the rest of the day.

That being said, we’re coming into resistance on the SPX, and after a nice two-day move, we’re likely due for a rest - which would be healthy.

For more on this, check out today’s ‘Daily Update’ video below.

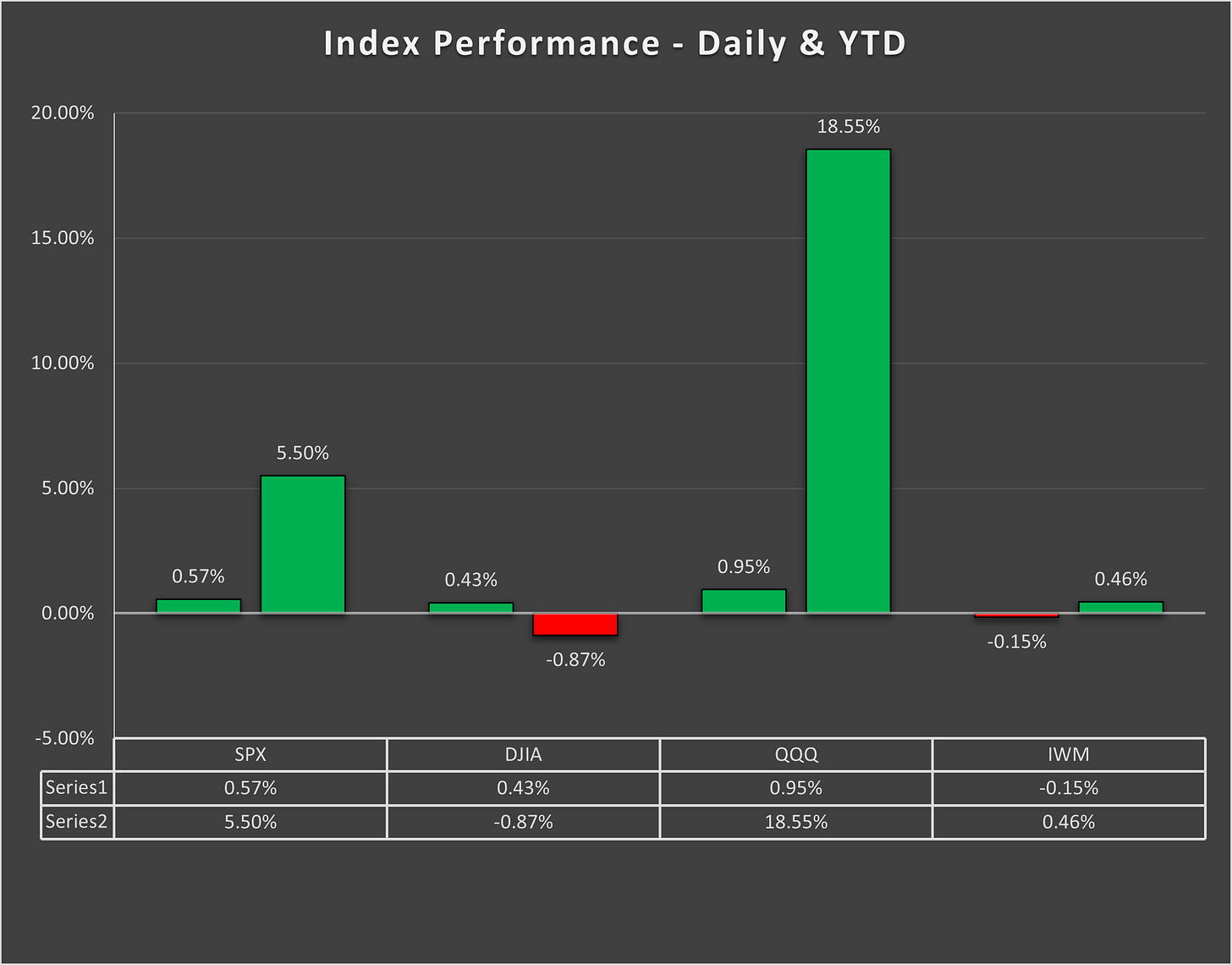

Market Snapshot

Sectors: 10 out of 11 sectors were UP.

- Winner: Real Estate +1.22%

- Loser: Financials -0.29%

Daily Update Video & Watchlists

Charts of interest: SPOT 0.00%↑ USO 0.00%↑ TSLA 0.00%↑ OKTA 0.00%↑ LEN 0.00%↑ AAPL 0.00%↑ GOOGL 0.00%↑ DKNG 0.00%↑

Note: The cash tags above are a new feature for Substack and the quotes still look a little wonky so refer to the prices in the ‘Daily Update.’

Check out this short video for a full explanation to use the Lund Loop watchlists to identify potential profit opportunities.

Click the links below for the ‘Daily Update’ video and to view the current watchlists & setups.