If you are not in the Lund Loop Discord you’re missing out. Check out the end of today’s video for info on how to get access.

The market took a day off today. This was not unexpected as we were due for a rest after a nice four day run.

What I’m doing right now is watching to see which stocks hold their recent gains during this pullback. That is a sign of good relative strength, and those are the stocks that should perform best if/when the current short-term uptrend continues.

And that’s still a big “if” because of the continued weakness we’re seeing in the bank-heavy Russell 2000 (IWM).

The question that’s on everyone’s mind right now is; will the Dow, Nasdaq, and S&P 500 eventually pull the Russell higher, or will the Russell end up pulling the rest of the market lower?

For more on this, check out the ‘Daily Update’ video below.

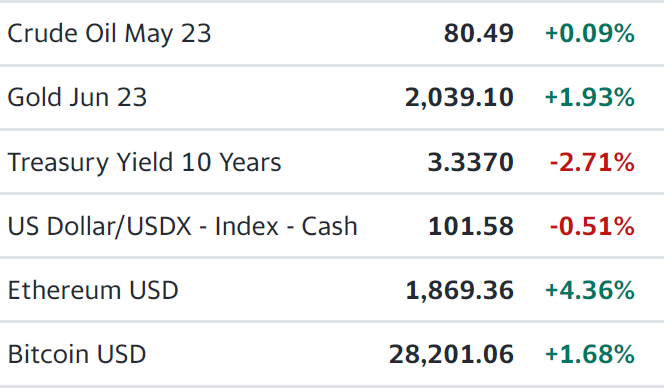

Market Snapshot

Sectors: 7 out of 11 sectors were UP.

- Winner: Utilities +0.52%

- Loser: Industrials -2.25%

Daily Update Video & Watchlists

Charts of interest: AAPL 0.00%↑ USO 0.00%↑ TSLA 0.00%↑ DKNG 0.00%↑ AMZN 0.00%↑ MSFT 0.00%↑ SPOT 0.00%↑

Note: The cash tags above are a new feature for Substack and the quotes still look a little wonky so refer to the prices in the ‘Daily Update.’

Check out this short video for a full explanation to use the Lund Loop watchlists to identify potential profit opportunities.

Click the links below for the ‘Daily Update’ video and to view the current watchlists & setups.