This post was written by my friend, the late great Jon Boorman, and is one of the best articles I’ve ever read on how to hold onto winning stocks.

One of the commonly repeated maxims in trading is to "cut short your losses, and let your profits run on." Attributed to David Ricardo, a political economist who rose to prominence in the early 19th century, it's one dear to the heart of momentum traders and trend followers, for it forms the very basis of what makes their methodology profitable. If something is costing us money we want to exit. If something is making us money we want to let it run.

Simple, right? But simple isn't easy.

Just like anything that might seem obvious, it's much harder than it sounds. It's like telling someone the best way to lose weight is to eat less and exercise more. Thanks, I didn't think of that.

The truth is you already know it, but rather than face reality you'd rather look for a less painful solution, a way to achieve the desired outcome with less effort. Unfortunately, whether trying to lose weight, or gain financial capital, you will have to use some mental capital along the way. That's because as a general rule, what's necessary to succeed in markets goes against human nature. We are not wired to do this.

One of the greatest temptations is to take profits too early. This is known in behavioral finance as the Disposition Effect, whereby investors are more willing to recognize gains than losses.

Be honest, have you sold something because it felt good to ring the register, even if your rationale for buying it in the first place was still intact?

'Don't be too greedy' we're told. "Bulls make money, bears make money, pigs get slaughtered."

Or when you've doubled your money, you should "take half off, then you're playing with the house's money."

Or my personal favorite "You'll never go broke taking a profit!"

These appeal to us, because they justify an act of instant gratification. You were right and you made money. 'It's sensible and prudent to take the profit' we tell ourselves.

And very often one of the driving factors behind our compulsion to act, is the profit we see in dollar terms or as a percentage return. Why do we feel the urge to take that profit simply because it's up 10%, 20%, 50%, or even 100% from where we bought it? Because it's a nice big round number and it makes you feel good? Pretty much.

It's fulfilling some emotional need, a weakness you'd rather not address. There's no empirical reason why you should willingly bring to a premature end a perfectly good position.

Didn't you enter the position based on its price action, its technical pattern, its value, its trend? So why would you exit based on your P&L?

It's an arbitrary price level on the chart, suddenly given significance by you because of its relative distance to where you bought it. You've unwittingly created an emotional anchor to that price, which otherwise was of zero consequence.

Now if you don't take profits and it sells off, you'll beat yourself up and say you were greedy. If it continues higher, you'll convince yourself it doesn't matter it went up a further $5 and you'd now be making 67% instead of 33%, it was the right thing to do. "You'll never go broke taking a profit!"

The simple answer?

Take your return off your screen.

Try it.

You can't control what happens in the market, but you can control what you buy, where your stop is, your position size, and what information you use to monitor your positions and your portfolio.

Does your broker platform have a column showing the return on your trade? Get rid of it.

Does your platform have a column showing what price you entered? Get rid of it.

They're of no relevance. All you should care about is whether the position you have is still valid or not.

You only need to know where the current price is, and where your stop is.

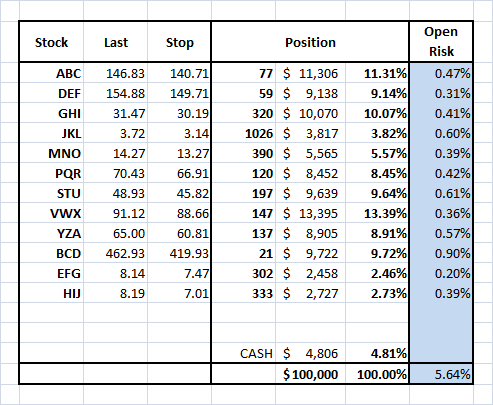

If your broker platform isn't adaptable, try monitoring positions via a spreadsheet, where in addition to the last price and your stop, you can also monitor your open risk as a percentage of your portfolio. That's what I look at.

Here's a hypothetical $100,000 portfolio as an example:

One of these positions is up 48% from its entry, another up 27%. One is -2%, another -5%. You'd have no idea which and you don't need to. It's irrelevant. Knowing that information will only tempt you to treat it differently.

For each position I place my stop where the trend is invalidated, so each day I ask myself one question.

Is it still in an uptrend for my timeframe?

Yes = Do nothing.

No = Exit.

Trade your position, not your P&L.

Do that, and you may find yourself running winners longer and for larger gains, than had you left yourself open to the emotional biases from monitoring your return.

To learn more about Jon Boorman please see: In Memoriam.

P.S. It should go without saying - but I’ll say it anyway - all opinions expressed in The Lund Loop are my own personal opinions and don’t reflect the views of my employer, any associated entities, or other organizations I’m associated with.

Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.

very good concise advice