What’s more uncomfortable for investors, a roaring bear market or a raging bull?

At first this might feel like a trick quick question.

Bear markets suck and everyone loses money, except of course for shorts, who initially make money, but, being the doom and gloom malcontents they are, unsatisfied until everything goes to zero, overstay their welcome and eventually get their heads ripped off during the first countertrend rally after the bottom is in.

Bull markets on the other hand are when a rising tide lifts all boats and everyone makes money. But despite the new-high headlines, the giddy CNBC anchors, and the FinTwit euphoria, just below the surface of the raging bull lay discontent, discomfort, and in many cases, true pain.

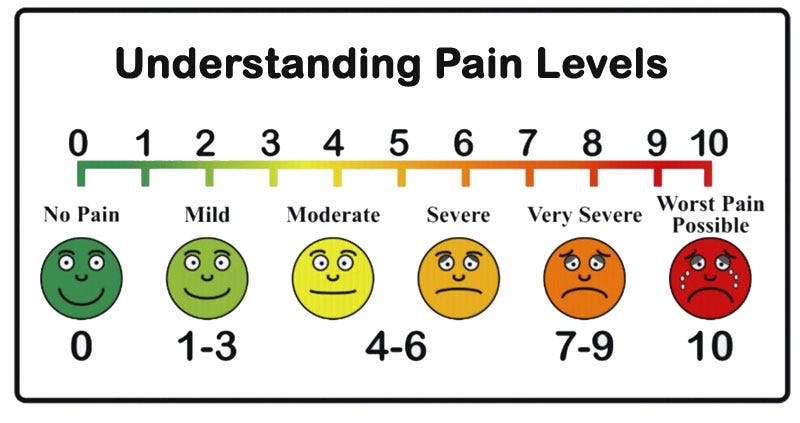

In the drafty, sterile confines of the emergency room, doctors frequently implore patients to quantify their suffering on a scale of one to ten. Yet what these white-coated custodians of care neglect to furnish their charges with is a key, a legend of sorts, to decode this rubric of pain.

However, as it turns out, this scale of torment has an official designation; The Pain Assessment Scale. This scale breaks pain into three broad categories: mild for the lower end of the spectrum, moderate for the middling numbers, and severe for anything north of seven. Coincidentally, this scale has an analog amongst participants in breakaway bull markets.

In order to make sense of these categories, we need to dissect them further:

Pain Free: (No impact on daily living activities)

This category is for those who don’t know the stock market exists. Well, they know it exists, but only in the abstract, as they refrain from interacting with it in any way, shape, or form.

They’re the type who would, in response to the question, “Why don’t you own stocks,” say - and somewhat proudly - “The stock market is just not for me.”

People who don’t own stocks? Yes dear reader, I can hear you now, shouting “balderdash,” “poppycock,” and other old-timey words at your screen.

But according to the latest Gallup Poll numbers, 61% of adult Americans own stocks, either individually or as a part of a retirement savings account, like a 401(k) or IRA. That leaves 39% of adult Americans - tens of millions - who are not participants in the greatest wealth creation machine in history - and oblivious to its gyrations.

New highs, new lows, overbought and oversold conditions, blow-off tops, capitulation bottoms, flash crashes, YOLOs and FOMO, mooning, diamond hands, and rug pulls, CPIs, PPIs, Fed minutes, gurus, and furus, all of these things and more mean nothing to this group, who live their lives blissfully ignorant of the daily machinations of the spawn of Buttonwood.

Sometimes I envy them.

However, most investors will fall somewhere higher up on this pain scale depending on their individual situation.

Mild Pain: (Nagging, annoying, but doesn’t really interfere with daily living activities)

1- Investment discomfort is very mild, barely noticeable. You’re a long-term investor, with decades until retirement, who knows that indexing has a proven track record and you’re content to let the market do it’s magic over time. Sure, you’re aware that some individual names are hitting new highs daily, but most of the time you don’t think about it, like that penny stock once bought on a whim.

2- Minor investment pain. Annoying and may have occasional stronger twinges, like when you missed out on that hot IPO in the 90s’. You own individual stocks, but they’re in a 401k or retirement fund. Even though you know they’re working for you, you’re starting to get that “I think I’m might be missing out” itch - and you’re tempted to scratch it.

3- Investment pain is noticeable and distracting, however, you can get used to it and adapt, like holding onto a stock that has seen better days. You don’t believe in timing the market, but, in a moment of weakness - after you watch Nvidia go up another 20-points - you say to yourself, “What the hell?” and decide to try buying some individual stocks - but only quality names. You convince yourself that you’re “just as smart as the other guy” and can figure this trading thing out. After all, how hard can it be to time stocks? You open a Robinhood account.

Moderate Pain: (Interferes significantly with daily living activities)

4- Moderate investment pain. If you are deeply involved in an activity, new highs can be ignored for a period of time, but it’s still distracting. You’re in the market, on the right side of the trend, holding a basket of names that keep moving higher, but your idiot brother-in-law keeps hitting you up to tell you about the latest YOLO stock or shit coin he bought that’s now mooning.

5- Moderately strong investment pain. It can’t be ignored for more than a few minutes, but with effort you still can manage to work or participate in some social activities, like making fun of your buddy when his meme stock blows up. You’re long, and in some big movers, but goddamn it, you’re not long enough!

6- Moderately strong investment pain that interferes with normal daily activities. Difficulty concentrating, especially when Nvidia runs another 100-points while you’ve been waiting for a “better entry spot.” Meanwhile, your individual stocks have barely moved. You revise your definition of “quality names” and spring for Robinhood Gold.

Severe Pain: (Disabling; unable to perform daily living activities)

7 - Severe investment pain that dominates your senses and significantly limits your ability to perform normal daily activities or maintain social relationships. Interferes with sleep. Your pain spikes with each new high because you sold everything at the bottom of the last bear market and have spent the time since convincing yourself that every rally was a “head fake.”

8 - Intense investment pain. Physical activity is severely limited. Conversing requires great effort. You’re holding individual names, but the wrong names. Everyday the market rips higher while your stocks dump.

9 - Excruciating investment pain. Unable to converse. Crying out and/or moaning uncontrollably. Your entire portfolio is bleeding red because you decided to get cute and short a breakout bull market. Your new favorite catchphrase is, “There’s no way it can go any higher.”

10 - Unspeakable investment pain. Bedridden and possibly delirious. Very few people will ever experience this level of investment pain. You’re fully invested, fully short, leveraged to the hilt, the margin clerk has your number on speed-dial, and you begin each morning by pleading to the stock market overlords, “GOOD GOD, PLEASE JUST MAKE IT STOP!”

Those who suffer from bull market pain are often tempted to just gut it out. But pain is often an indicator of an underlying condition, which, if left unaddressed could lead to a significant increase in severity.

If you suffer from bull market pain, examine your position sizing, your risk management, or lack thereof, as well as your general appetite for speculation. If none of these things help, or your symptoms increase, please visit a financial planner immediately.