What is R?

Any sound trading methodology has to incorporate risk management, and one of the easiest ways to do that is to use the “R” method.

“R” is a fixed dollar amount that stands for both risk and reward, and is best arrived at by using a percentage of your total trading capital. It allows you to size your position in relation to your risk level instead of in an arbitrary way.

For example, if you have $50,000 available in trading capital (cash not including margin), you might use one-quarter of one percent (.0025), or $125.00, as your “R” factor. This is the total amount you are willing to risk per trade and can be expressed as 1R.

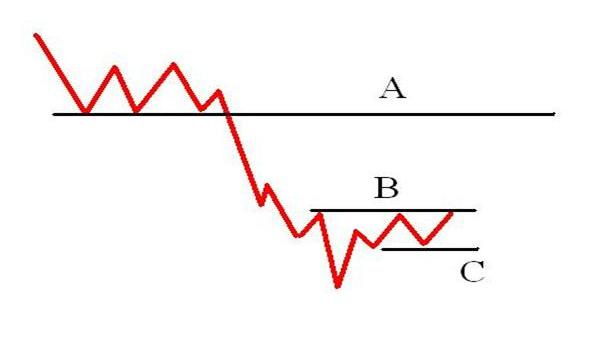

In the highly technical example below, A is a former support level that failed and now is a potential resistance level.

Price is trapped between B and C level, and you are looking to go long if it breaks back above B.

You know that a reasonable stop-loss would be just below level C, so you determine the price distance between your entry just above B and your stop just below C.

Let’s say that this distance is 50 cents. You now take that distance and divide it by your “R” factor, which gives you a position size of 250 shares ($125.00 / .50 = 250).

You now know that if your trade fails and hits your stop-loss, the most you can lose is $125.00 or 1R. The goal then becomes to only take trades where you have the best potential reward for your 1R risk, ideally 1:3.

In this same example, the resistance level of A is a reasonable target for a successful trade, so you determine the distance between your entry just above B, to the target of A. You then divide this number by your “R” factor to see if the trade is worth taking.

If the distance between A and B is $1.50 then you have a 1:3 risk/reward ratio and the trade is a good bet ($1.50 / .50 = 3).

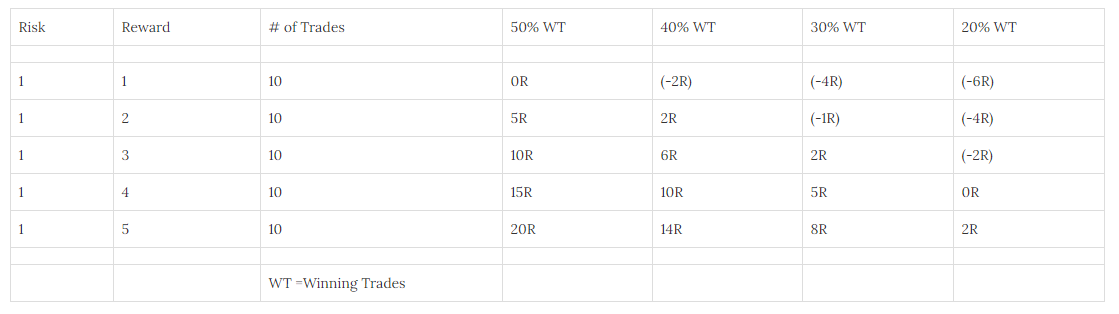

The higher the risk/reward ratio you have on your trades, the fewer times you have to be right to still make money, as the chart below illustrates.

(Click to embiggen)

As you can see, if you only take trades that have a 1:3 risk/reward ratio, you only need to be correct 50% of the time to have a 10R profit after ten trades.

Knowing how to use risk/return and position sizing allows you to make sure you are never overextended on a trade and ensures that you’ll always be able to return to fight another day.

Become a paid subscriber to the Lund Loop newsletter and you’ll get so much more.

And here’s the kicker, it’s less than $0.52 per day.

Just click the button below and become a subscriber today.

———————

P.S. It should go without saying - but I’ll say it anyway - all opinions expressed in The Lund Loop are my own personal opinions and don’t reflect the views of my employer, any associated entities, or other organizations I’m associated with.

Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.