The Problem Bears Face Right Now Redux

To get this weekend newsletter, as well as daily charts, market commentary, and the full Tuesday ‘Daily Update’ video delivered directly to your inbox, join over 7,500+ other traders and active investors by subscribing to the Lund Loop.

This is a slightly modified post from April 5th, 2020 (take a look at that date on a chart for reference).

It feels as relevant now as it did then, if not more so.

Ignore it at your own peril.

Ever come across this scenario?

You throw a party – back when we had parties – and later in the night, as things are winding down and people begin to leave, you notice one person who doesn’t realize it’s time to move on?

So you start sending signals.

First, you start with a yawn, saying, “Boy, I’m tired.”

Then you turn off the music and start cleaning up.

Finally, you change into your pajamas.

But the only response you get from the holdout is, “Hey, any more beer in the fridge?”

Sometimes people just don’t know when it’s time to leave the party. A lot of bears may find themselves in that position very soon.

Despite the fact that the market has been in a relentless downtrend for most of the year, with the Naz off almost 30% at one point and a plethora of grow stocks getting hit for 70, 80, even 90 percent in some cases – they still want more downside.

And who knows, they still may get it yet.

The problem is, the bears don’t understand that this is not a single party, it is a series of parties that occur in all sorts of different time frames.

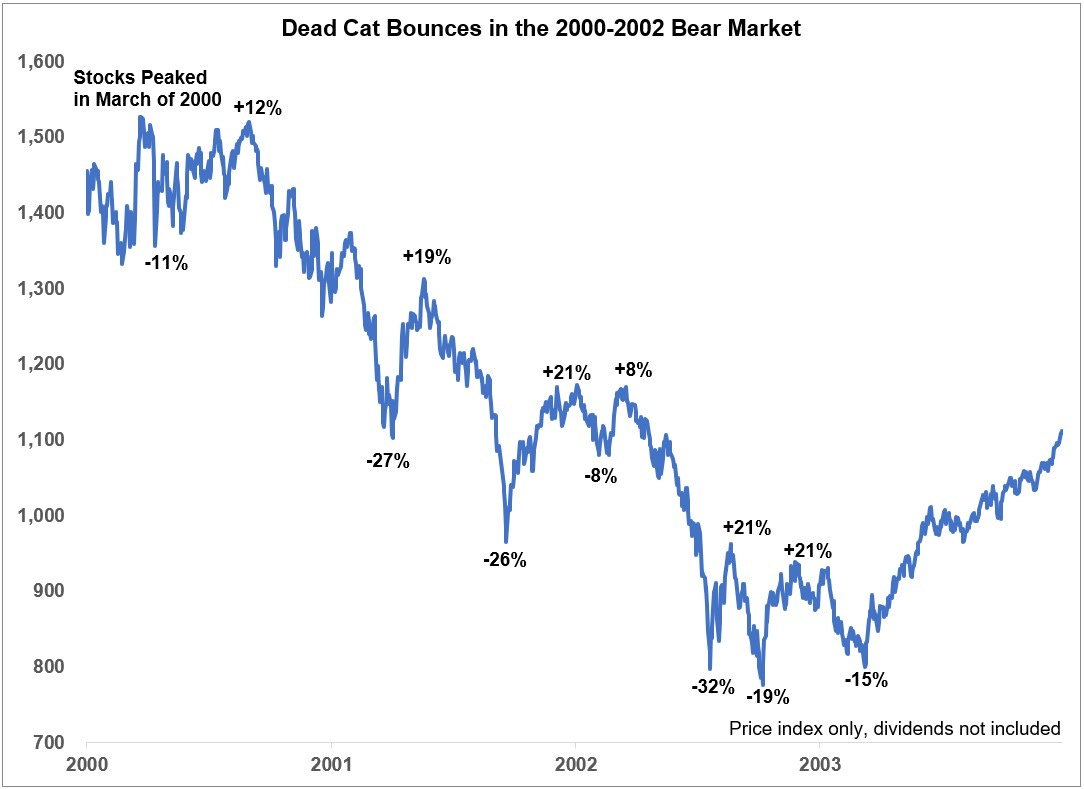

Because I’m lazy and he does this stuff better check out a piece Ben Carlson wrote a couple years back entitled, “A Short History of Dead Cat Bounces,” which illustrates the problems bears who stick around too long face.

As the chart above clearly shows, bear market rallies are notorious for their face-ripping ferocity, making it hard to stay positioned short, and it only takes a quick rally or two to undo the profits that were made on the recent drop.

But the other risk factor that laggard bears have is their propensity to think everything should go to zero.

That’s because it takes a certain mindset to be a bear, one that is never satisfied with enough bad news or wealth destruction.

And one that is loath to acknowledge when the worst has passed.

We saw this play out after the market bottomed in early 2009 as the bears who were still at the party – not satisfied with a 57% drop from all-time highs – stayed on the sidelines, or worse yet, kept trying to get short, as the market went on to post one of the greatest bull market runs in history.

It’s a tough racket being a bear, particularly in a stock market that for 100 years has had an upward bias, but now that the “easy” downside money has been made, it’s going to be much harder to be a profitable bear going forward.

The Lund Loop is about the intersection of markets, trading, and as you just saw, life - but it’s more than that.

It’s a community of traders and active investors who are committed to helping everyone crush the markets. Basically, we’re the anti-FinTwit.

If you’d like to take advantage of everything the Lund Loop has to offer, consider becoming a paid subscriber.

It should go without saying - but I’ll say it anyway - all opinions expressed in The Lund Loop are my own personal opinions and don’t reflect the views of my employer, any associated entities, or other organizations I’m associated with.

Nothing written, expressed, or implied here should be looked at as investment advice or an admonition to buy, sell, or trade any security or financial instrument. As always, do your own diligence.